|

| Sergey Lavrov, bang your shoe on the lectern for emphasis. |

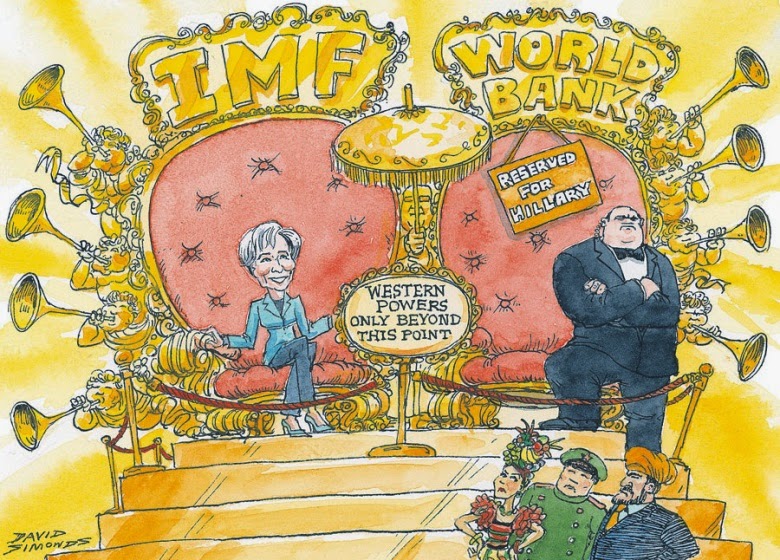

As much as Russia benefits from the ancien regime of the UN--the Security Council remains composed of the victors of WWII like itself, Russia has yet to break into that even more exclusive club of Western powers. Sure, it used to be part of the security-oriented G-8--the economics-oriented G-7 plus Russia--but those days are gone. Whether rightly or wrongly, Russia has been put in the West's doghouse at an inopportune moment: (1) It was already in recession pre-EU sanctions; (2) the EU-sanctions have estranged it from its main export market for energy; (3) the price of energy is dropping besides; (4) Russia and its firms now have trouble raising money abroad; and (5) Russian banks have substantial foreign borrowings that are coming due over the next few months.

Add up (1)-(4) and it looks pretty bad for Russia all around--especially its international finances with little foreign exchange coming in and much of it going out. Yes, Russia did save up some when energy prices were high over the past few years, but those may not be enough. The Financial Times offers this assessment of how long it will take to deplete Russian reserves:

In an assessment paper on the Russian economy, EU economic officials in Moscow warn that the three big banks alone will need $75bn from the central bank over the next 18 months, draining its reserves.

Combined with the requirement to keep at least $180bn of foreign exchange reserves to cover six months of imports, that would leave the central bank with just $115bn to defend the currency in case of speculative attacks or sudden capital flight. In early March, the bank converted $11.3bn into roubles in a single day. “It therefore cannot be excluded that Russia’s macro-financial situation over time could become one of financial distress,” the paper concludes.To be honest, I am not sure how the FT came to this assessment. As of July, Russia had $407.8B in currency reserves; $468.7 billion if you include its precious metal holdings. So it's more like $407.8B-($75B+$1805B) = $152.8B that it will have left to defend the ruble against possible currency speculation after setting aside bank financing and enough money to buy exports for six months as per the convention of reserve adequacy. It again sounds pretty substantial, but in this day and age, you have to wonder.

Then again, 18 months' time may even be generous. Reuters reports that a year may be all that's left in the tank:

Russia has considerable reserves to draw on - currently around $469 billion in gold and foreign exchange - and no immediate need to tap the markets for new capital. Many argue the measure would be more symbolic than punitive.

However, the country's dependence on increasingly unstable oil and gas revenue and commitments by Moscow to provide finance to sanctioned companies prevented from raising money abroad could see it backed into a corner. "It's quite difficult to tell how long they have, I'd put it at more than one year. But it's not static," said Viktor Szabo, a portfolio manager at Aberdeen Asset Management. The strain on those reserves is growing, Szabo said. Economic growth is ebbing fast, with gross domestic product expected to grow by 0.3 percent at most this year and energy export revenues are falling. A run on the currency would also shorten the time Russia can continue in isolation, Szabo said.And here's another take after considering falling energy export revenues' effects on state finances:

A particular headache is the falling price of oil. Oil and gas account for around two-thirds of Russia's exports and close to half its federal budget revenues. Over the course of a year, each $1 fall in the oil price wipes around $1.4 billion off federal tax revenue. The state budget is based on an oil price of $104 for 2015, and Deputy Finance Minister Alexei Moiseev has warned recently those projections may be optimistic, with prices below $100 now a possibility.For all its posturing, I honestly believe Russia has bitten off more than it can chew and overplayed its hand. But hey, whoever said it's a fair world? Go ask Sergey Lavrov.

Craig Botham, an economist at UK fund manager Schroders, also calculates Russia's foreign exchange reserves would take little more than one year to be depleted. "If we assume the full $80 billion of external debt maturing this year is financed by the central bank ... and the same amount of financing is needed each year, the average monthly rate of decline in the reserves so far this year - $6.7 billion - continues indefinitely as the central bank continues to defend the currency, then FX reserves are exhausted some time in 2016," he said.