♠ Posted by Emmanuel in Americana,Cheneynomics

at 6/30/2012 03:38:00 PM

The New Yorker has an interesting new take on one of my favourite research genres, the search for the behavioural pathologies which account for terminal American decline, be it in health, income, wealth, life satisfaction or what else have you. Why should a clearly regressive society influence so much of what goes on in the rest of the world? It is not exactly news to the rest of the world that American parenting is as crappy as it gets, hence the search for solutions from more parentally enlightened societies [1, 2]. Nor is it news that American stewardship of the world economy is nearly as bad. Ultimately, these two are likely interrelated: While Bart Simpson and that Yanqui brat they caned in Singapore were all the rage in the nineties, let's just say things have gone downhill since then Stateside. In time, individual pathologies snowball into something unfathomably huge alike $1,000,000,000,000+ annual deficits whose momentum can hardly be arrested.

Recent anthropological research suggests these pathologies have their roots in households throughout the Land of the Free Loader:

Obama and Bernanke are perfect examples of really poor American parenting as they indulge bratty behaviour time and again. Instead of being leaders, they are led by those who don't know any better who demand instant gratification. Just throw more money at the problem and hope it goes away, nevermind that these exercises in fiscal and monetary irresponsibility are becoming increasingly unaffordable and ineffective besides. As the bankers at the height of the subprime era understood, the likes of Obama and Bernanke innately reason that they'll be gone anyway as things sink into further oblivion. In other words, they fit right into contemporary America. It's alright, son, deficits don't really matter because there's a global savings glut. It's not really my fault that deficits have ballooned during my term, they're all Dubya's fault. And so on and so forth.

As before, my suggestion for these folks and their innate preference for appeasers is to just grow up and deal with it. Stop running massive deficits you expect others to fund. The rest of the world does not have infinite patience dealing with your tantrums as you suck up the world's capital and throw it out the pram. In the end, perpetual childhood being programmed into American youth is symptomatic of wider pathologies indicative of all-too-evident societal decline:

Recent anthropological research suggests these pathologies have their roots in households throughout the Land of the Free Loader:

Often, the [L.A.] kids had to be begged to attempt the simplest tasks; often, they still refused. In one fairly typical encounter, a father asked his eight-year-old son five times to please go take a bath or a shower. After the fifth plea went unheeded, the father picked the boy up and carried him into the bathroom. A few minutes later, the kid, still unwashed, wandered into another room to play a video game.These vignettes are awfully similar to what you get in modern America. With the economy tanking again despite untold trillions spent to--erm...I'm not sure if these guys have achieved anything in the way of sustained progress--the proposed solutions once more involve spending massive debt-fuelled sums to silence this society of whingers. "As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate" says the fawning brat appeaser Ben Bernanke. Meanwhile, Obama largely ignores somewhat better parenting suggestions from the Budget Supercommittee he himself convened in fear of offending the juvenile sensibilities of the American electorate.

In another representative encounter, an eight-year-old girl sat down at the dining table. Finding that no silverware had been laid out for her, she demanded, “How am I supposed to eat?” Although the girl clearly knew where the silverware was kept, her father got up to get it for her.

In a third episode captured on tape, a boy named Ben was supposed to leave the house with his parents. But he couldn’t get his feet into his sneakers, because the laces were tied. He handed one of the shoes to his father: “Untie it!” His father suggested that he ask nicely. “Can you untie it?” Ben replied. After more back-and-forth, his father untied Ben’s sneakers. Ben put them on, then asked his father to retie them. “You tie your shoes and let’s go,’’ his father finally exploded. Ben was unfazed. “I’m just asking,’’ he said.

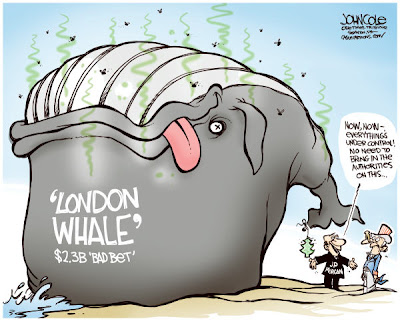

Obama and Bernanke are perfect examples of really poor American parenting as they indulge bratty behaviour time and again. Instead of being leaders, they are led by those who don't know any better who demand instant gratification. Just throw more money at the problem and hope it goes away, nevermind that these exercises in fiscal and monetary irresponsibility are becoming increasingly unaffordable and ineffective besides. As the bankers at the height of the subprime era understood, the likes of Obama and Bernanke innately reason that they'll be gone anyway as things sink into further oblivion. In other words, they fit right into contemporary America. It's alright, son, deficits don't really matter because there's a global savings glut. It's not really my fault that deficits have ballooned during my term, they're all Dubya's fault. And so on and so forth.

As before, my suggestion for these folks and their innate preference for appeasers is to just grow up and deal with it. Stop running massive deficits you expect others to fund. The rest of the world does not have infinite patience dealing with your tantrums as you suck up the world's capital and throw it out the pram. In the end, perpetual childhood being programmed into American youth is symptomatic of wider pathologies indicative of all-too-evident societal decline:

Or adultesence might be just the opposite: not evidence of progress but another sign of a generalized regression. Letting things slide is always the easiest thing to do, in parenting no less than in banking, public education, and environmental protection. A lack of discipline is apparent these days in just about every aspect of American society. Why this should be is a much larger question, one to ponder as we take out the garbage and tie our kids’ shoes.As ghastly as it is, observing the US self-destruct is not only useful but necessary for two reasons. First, the rest of us need to figure out how to refashion global governance in a way that is less dependent on these people who haven't the slightest idea of how to run a nation, let alone the world. We can make it without these infantile American whingers and should be better of without them. Second, their bad example is precisely that which we should seek to avoid--unless you want to as progress-free as they are, that is.